In my many years of serving Seniors in assisting them in understanding Medicare and making sure they have the best strategy which will reap the lowest out-of-pocket medical cost, I have found confusion to exist in the understanding of Medicare Advantage and Medicare Supplements. We intend to clear up the difficulty and enable you to make the best decision for you and your family.

When you are approaching, the age of 65, you’ll start to become aware of Medicare. They will have to make decisions about enrolling in Medicare as well as a choice as to whether they would like to offset the cost of Medicare with a Medicare Supplement or Medicare Advantage plan. The purpose of this paper is to explain and contrast the benefits of Medicare Supplements and Medicare Advantage plans. You will learn about the enrollment process as well as the benefits of an Advantage plan or a Supplement.

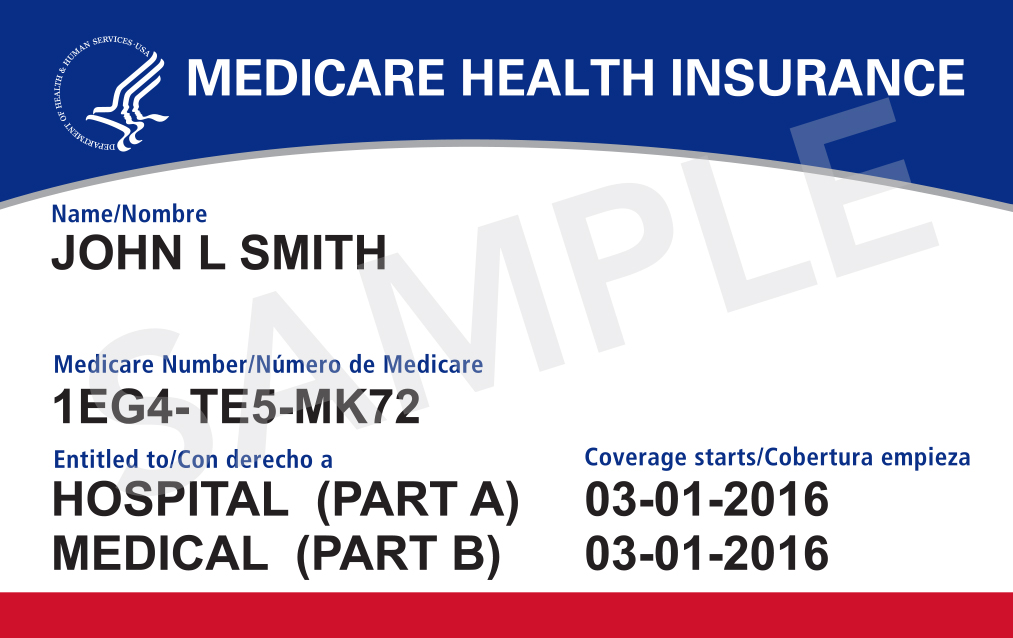

It is important to note that you are not required to enroll in a Supplement or an Advantage plan. You are not required to enroll in Medicare. Medicare has three essential parts that are labeled Medicare Part A, Medicare Part B and Medicare Part D. If you have worked at least 20 calendar quarters and contributed into Social Security, you are eligible for Medicare. There is no cost to participate in Part A (hospitalization), but there is a cost to participate in Part B (Medical) and Part D (prescription). The cost of Part B is, for most people, $134.80 per month. The prices for Part D are determined by the prescription drug plan you elect.

To be eligible for Medicare, you must be 65 years old. If, however, you are determined disabled and are receiving Social Security benefits, you may apply for Medicare. Medicare has a particular enrollment period when you first become eligible. You may enroll in Medicare three months before your birthday month and three months after your birthday month. If you register three months’ prior your Medicare benefit will begin the first day of your birthday month. If you enroll three months after you turn 65 your start date will be the first of the month following the date you enroll. To enroll in Medicare, you can make an appointment with your Social Security office, you can call Social Security, or you may go to www.medicare.gov. It takes less than five minutes to enroll in Medicare by using the internet.

When you enroll in Medicare, you will find that Medicare does not cover all your medical cost. Listed below please find some of the expenses you will incur:

Part A Deductible: You pay a $1364 calendar Year Deductible

Daily Hospital Confinement 61st – 90th day: You pay $341.00

Daily Hospital Coinsurance 91st -105th day: You pay $682

Daily Skilled Nursing Facility Coverage: You pay $167.50

Part B Calendar Year Deductible: $185.00

The amount you pay after Part B deductible: 20%

For a better understanding of your potential Medicare cost, you can go to www.medicare.gov

As you can see, there is a cost you will incur. To offset these costs, many individuals choose to enroll in a Medicare Supplement or Medicare Advantage Plan. These two plans are in addition to Medicare Part A, and Part B. One third of beneficiaries will elect a Medicare Advantage Plan while two thirds will elect a Medicare Supplement Plan.

Medicare Advantage Plans

Medicare Advantage Plans are private health insurance plans. While you may have to pay a premium for the plan in most cases you will find the premium is lower for a Medicare Advantage Plan when compared to a Medigap (Medicare Supplement Plan) The premium is lower but there are reasons for the premium being low.

Provider Network

In an Advantage plan, you must choose your care from a network of providers. In most cases, you may not go outside the network of doctors or providers. It is recommended that if one elects a Medicare Advantage Plan, you be sure to determine if your doctors or hospitals are in the plan. It is essential to do this to avoid any undue frustration.

Prescription Coverage

Most Advantage plans will provide coverage for prescriptions. If you are taking medication, you should check the plan’s formulary to make sure your drug is covered. A stand-alone Medicare Part D plan also has a formulary which you should check. We cannot stress enough the importance of auditing the formulary. If you do not check the formulary and you later find your prescription is not covered, you will have very little recourse.

High Out-Of-Pocket Cost

A Medicare Advantage plan may have various copayments, deductibles, and coinsurance amounts you may have to meet. One will have an out-of-pocket maximum (money you spend). For 2019 the annual out of pocket maximum is $6700.

Additional Benefits

An Advantage plan may have other benefits, such as dental and vision coverage. While these may be attractive to make sure to understand what the benefits are as in many cases, they are somewhat limited. Also check to see if you must elect certain providers and if so, check to see if your provider is part of, the network.

Medicare Supplements

A Medicare Supplement is a plan offered by a private health insurance company that can help pay the cost that Medicare does not pay. The plan is guaranteed renewable, and there are no claims to pay. After Medicare has paid what Medicare will pay the claim is automatically and electronically sent to the Supplement company to be paid. You do not have to re-enroll in a Supplement each year. If you pay the premiums, you will continue to have coverage.

Provider Network

There is no provider network with a Medicare Supplement. If you use a provider that accepts Medicare reimbursement, you will be covered by the Supplement. This means that if you are traveling anywhere in the United States, you will have excellent access to care as you are not limited to a provider network.

Coverage for Pharmacy Medications is Additional

Your Medicare Supplement may cover any medications administered at your doctor’s office. To get the prescription from the pharmacy, you will need to enroll in a stand-alone Part D plan (prescription plan). If you are receiving care in the hospital and taking medication for your care, this should be covered under Medicare Part A (hospitalization). Part D plans on the average run about $35 per month, but you can get one for less than $20 per month.

Low Out-Of-Pocket Cost

When using a Medicare Supplement, you will have a very low out-of-pocket cost. If you have Supplement F, G, or N, your cost will be minimal. Supplement G only requires you pay the Part B Annual Deductible of $185. After you have met the Deductible, 100% of the cost is funded by the Supplement G. Supplement N is very similar to Supplement G in that you must first meet the $185 Part B deductible. After you have met the Deductible, you will pay a $20 copayment for a doctor’s visit.

Enroll at Any Time

You may enroll in a Medicare Supplement Plan at any time. However, as long as you enroll in your open enrollment window, you will not have to answer health questions. The open enrollment window exists when you first become eligible for Medicare Part B. You have six months from first becoming available for Part B to enroll in a Medicare Supplement without having to answer medical questions.

The Choice

Now that you know the basics of a Medicare Advantage Plan and a Medicare Supplement, you need to make a choice. You need to evaluate your needs to determine the best fit for you.

A Medicare Supplement may have a slightly higher premium than a Medicare Advantage Plan. You will have much greater flexibility with a Supplement and in most cases, less out of pocket cost when the plan is used.

A Medicare Advantage Plan will provide, in most cases, a lower monthly premium. You will have copayments, deductibles, and a higher out-of-pocket cost. You may also have dental and prescription benefits included in the plan. Please review these benefits because in most cases, they may not be what you have been used to or what you expect.

Final Thoughts

The decision you make as to a Medicare Advantage Plan or a Medicare Supplement will have lasting consequences on how your health care is covered in the future and the cost you will incur. We suggest you have a conversation with an individual that is knowledgeable and professional and that can assist you in the process of understanding your options.

We at The Medigap Pro would welcome the opportunity to help you with your Medicare choices and understanding. We are an independent insurance broker with a national reputation that specializes in all things Medicare. You may reach us by calling, 1-800-535-8016 or you may connect through our web site at www.mdigappro.com